These days I often come across companies with several acquisitions but not fully integrated. This is quite pronounced in the mid-market segment, especially those backed by mid-size Private Equities (P.E.).

It is not that there is no integration. In most cases, there is a financial consolidation. There are some other back-office consolidations like common payroll, email, and some other services. Beyond the back office, there is hardly any integration to name. Activities that involve client-facing and client-supporting activities like Sales, marketing, product management, and customer service continue to operate independently even in the consolidated structure.

These organizations end up with a cauliflower organizational structure. The back office is consolidated like the stem of the flower but the client-facing activities remain distinct and independent like the florets.

These create two problems for organizations.

The first one is that most acquisitions have a growth story that is articulated in the investment thesis. This growth potential often is the main driver of an acquisition. However, once the transfer of ownership takes place and the initial euphoria of acquisition is over, the main challenge of integration surfaces. The “How” of realizing the potential growth after the acquisition. This is a big struggle area that many companies face. They do a great job of pursuing the “What” and “Why” that culminates in an acquisition. But start struggling when need to implement it.

Let us take the example of the sales organization. An initial acquisition announcement greatly excites a sales team. The sales guys start believing that they will now have access to a much bigger customer base where they can sell their products.

But as the integration processes unfold the sales teams soon realize the real challenges of cross-selling. Where they expected a cakewalk, after some initial effort they realize that cross-selling needs a considerable amount of effort and time. Under these circumstances, they revert back to their old ways of selling their original products in their own segments.

And without a sound strategy, the above example is much more likely to happen than otherwise.

The second problem is where there is an overlap in the customer base. Without a consolidated go-to-market strategy, the companies continue to operate independently. As a result, they miss an opportunity to create a combined and better customer solution. This stems from an intrinsic fear that any effort in a collaboration that results in a failure can erode their existing customer relationship and can be detrimental to the original companies.

Both the problems articulated above happen due to a lack of strategic thinking based on the customer-product overlap between the acquiring and the acquired company.

So, how do we address this challenge?

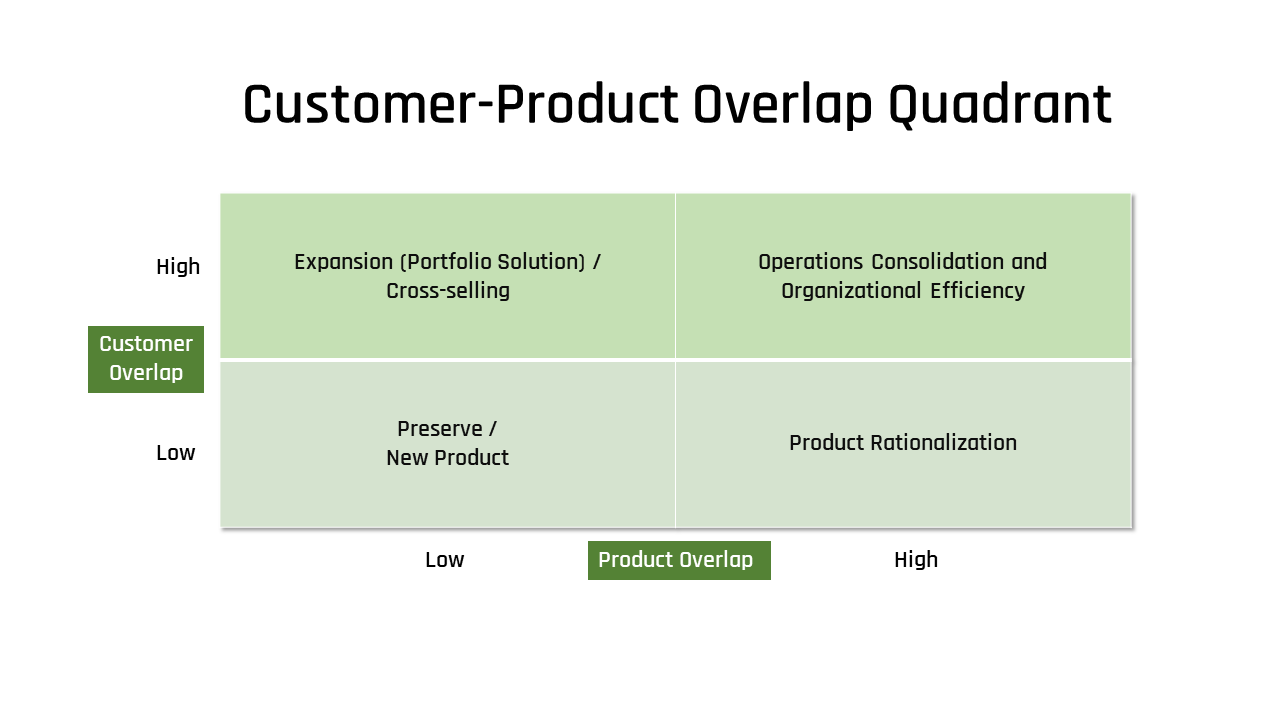

One of the tools that we have developed is called the customer-product overlap quadrant. It is a 2×2 quadrant where we map the overlap of customers with the overlap of products as you can see in the image.

In this image, we have defined four distinct strategies that organizations can pursue on the basis of customer-product overlap.

Consolidation

A consolidation strategy needs to be pursued when there is a high overlap of both products and customers between the acquiring and the acquired company. Without a strategy, there is a significant chance of cannibalization, erosion of margin,s and most importantly, brand corrosion.

This category includes the acquisition of competitors.

When you do this mapping exercise, it is best done at the individual product or product family level. Many companies have multiple products. When you do the exercise at a product/product family level you will realize that some products have less overlap compared to the others. To get the best out of this exercise, you should do the mapping at an individual product level or at a product family level. You must avoid the temptation to map it at a company level or an overall product level.

The strategy for this category should be focused on organization consolidation and organizational efficiency. Organizations must look at their overall organizational design, technology diversity, sales and marketing functions as well as middle and back-offices. You should consolidate to form one organization with a rationalized set of products.

Product Rationalization

This is the category where there is a high product but low customer overlap. In other words, the two consolidating companies largely operate in distinct customer segments with very similar products.

This is a great opportunity for companies to consolidate and rationalize the combined product portfolio. It can bring in greater production and operational efficiency, and increase profitability.

Portfolio Solution

Under this category, the customer overlap is high but product overlap is low. This phenomenon is seen in companies that have different products that address different requirements for the same customer base.

This is the category that can offer the highest potential for revenue synergies in an integration. By combining products and services into a new portfolio solution, you can offer a new solution that meets a bigger customer requirement.

For these new offerings, companies can now charge a premium, that can increase both revenue and profitability. It also prevents your products from being commoditized and moves you up the value chain of an industry.

Preserve

The last category is where both the customer overlap and product overlap are limited. Here, the companies operate in different customer segments and offer different products and solutions.

Due to limited overlap, there are primarily two strategies that can be pursued. The first is to “preserve” the companies as distinct operations and remain independent with limited opportunities to consolidate back-office and support functions like HR, Finance, IT, and Procurement.

The other strategy would be to innovate and develop new products that can increase the customer overlap.

Summary

Many companies in the mid-market struggle with their integration even after a successful acquisition. Companies end up with some back-office consolidations but struggle to handle consolidation of the front-office functions like sales, marketing, product management, and customer service.

The main reason is that companies try to take only a customer overlap view rather than taking a product-customer overlap view. The tool that we have shared in this article gives a simple and easy way to map the customer-product overlap.

The quadrant will help your thinking to focus on four distinct conditions to create a sound and focused strategy for each condition.

An acquisition is made to foster the growth of a company. And therefore, each company should fundamentally get that growth. But many of them struggle!

That is why, we have made it our vision and endeavor to provide tools, methods, and frameworks that companies can leverage to realize their dreams in a simple and effective way.

The customer-product overlap quadrant is one such tool.